As we close in on the new year, we need to start thinking about next year’s finances and how to control them. Budgets???? We are currently working on our family budget for 2017 which will be coming available in a few days when we finish it. It is a Debt free based budget and we wanted to include our goals for personal accountability. When you have debt, paying that off is your only goal. Without any debt, your next goal/focus should be on savings (All different kinds of savings) otherwise your money will slip away if it does not have a name. We hope to challenge you as well as encourage you to stay out of debt if you’re debt free, get out of debt if you’re in debt and finish this new year with some financial goals achieved.

Here is a link to an article from the Motley Fool written in February 2015 with statistical information on typical savings rate per household for a given age group. Based on that information, our household should be saving -1.8%. Yes that is a negative which means we should be adding to our debt 1.8% on average every year. Well, we are not average nor do we want to be. The Jones are average, Jack and Jill are average(no offense) but we are not average in any way. So we are going to set our projected annual savings percentage at 35% for 2017 on top of retirement which is pulled off before taxes. To borrow Median Household Income from the article, the average house hold income below age 35 is $52,702. If that household saves -1.8% per year they are going into debt $948.64 every year. If that same house hold saved 35%, then they would have $18,445.70 in savings at the years end. I’m 33 years old right now so we would have $36,891.40 in savings by the time I am 35. That is a problem I can live with.

Spend this month of December looking at your financial goals. Whether it is getting debt free or saving. Make goals that are achievable and change from being average to being weird.

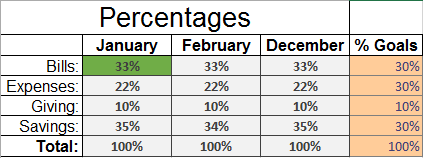

One of our goals for this new year is to post our actual monthly percentages for savings, giving, bills and expenses. We will track these items at the end of every month and post on here. We challenge you to follow along with us and keep track of your own percentages.

Stay tuned next week for the 2017 budget that we will be using.

Leave a comment